Credit Repair: How Long Does It Take to See Results?

When it comes to credit repair, one of the most common questions people have is, “How long does it take to see results?” The journey to improving your credit score can be a bit like a marathon, but understanding the factors that influence the timeline can help you set realistic expectations. In this comprehensive guide, we’ll explore the various aspects that impact the duration of credit repair and provide tips to help you achieve faster results.

The Starting Point: Your Current Credit Situation

Before we delve into the timeframes, it’s essential to understand that the length of your credit repair journey largely depends on your current credit situation. Here are a few scenarios:

-

Minor Issues: If your credit report contains only minor errors or a few late payments, you might see improvements in as little as a few months.

-

Moderate Damage: If your credit report has multiple late payments, collection accounts, or charge-offs, it may take six to twelve months or more to repair your credit.

-

Severe Damage: In cases where you have bankruptcy, foreclosure, or numerous derogatory marks, credit repair may take several years.

Factors Influencing the Timeline

Several factors influence how long it takes to repair your credit:

-

Type and Number of Negative Items:

The more negative items on your credit report, the longer it typically takes to address them. Items like late payments, collections, and charge-offs can be more challenging to remove.

-

Credit Bureau Response Time:

Credit bureaus have 30 days to investigate disputes and update your credit report. If they require additional information or the dispute process becomes prolonged, it can extend the timeline.

-

Your Commitment:

Your dedication to the credit repair process plays a significant role. Regularly monitoring your credit, addressing issues promptly, and making timely payments can expedite progress.

-

Creditors’ Cooperation:

Sometimes, creditors may be slow to respond or unwilling to remove negative items. Negotiating with them effectively can influence the speed of credit repair.

Steps to Expedite Credit Repair

While credit repair does take time, there are steps you can take to expedite the process:

-

Check Your Credit Reports Regularly:

Obtain copies of your credit reports from all three major credit bureaus—Equifax, Experian, and TransUnion. Review them for errors or inaccuracies.

-

Dispute Inaccurate Information:

If you find errors or discrepancies on your credit reports, dispute them immediately with the credit bureaus. They are required to investigate and correct any inaccuracies within 30 days.

-

Pay Bills on Time:

Consistently making on-time payments is crucial for credit repair. Set up reminders or automatic payments to ensure you never miss a due date.

-

Reduce Credit Card Balances:

High credit card balances can negatively impact your credit utilization ratio. Aim to pay down balances to below 30% of your credit limit.

-

Negotiate with Creditors:

If you have accounts in collections or overdue debts, negotiate with creditors for payment plans or settlements. Getting these accounts in good standing can improve your credit score.

-

Establish Positive Credit History:

Consider opening a secured credit card or becoming an authorized user on a trusted friend or family member’s account to establish positive credit history.

-

Monitor Your Progress:

Regularly monitor your credit score and reports to track improvements. Many online tools and services offer free credit monitoring.

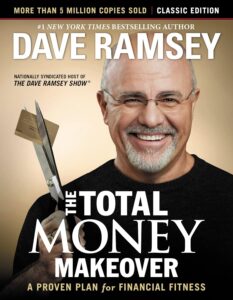

Learn Personal Finance and Budgeting through this fun game!

Realistic Expectations

It’s essential to have realistic expectations when it comes to credit repair. While some improvements can happen relatively quickly, a complete overhaul of your credit score may take time, especially if you’ve experienced severe credit damage. Here are a few things to keep in mind:

-

Patience is Key:

Credit repair is a gradual process. Don’t be discouraged if you don’t see immediate results. Stay committed to your financial goals.

-

Continuous Improvement:

As you work on repairing your credit, focus on maintaining good financial habits for the long term. This will help you build a strong credit history.

-

Credit Score Factors:

Remember that multiple factors contribute to your credit score. While negative items can be removed or improved, factors like length of credit history and types of credit accounts also play a role.

-

Professional Help:

If you’re struggling to make progress on your own or feel overwhelmed, consider seeking assistance from a reputable credit repair company. They can help navigate the process.

The Final Word

Credit repair is not a one-size-fits-all journey, and the timeline varies from person to person. The key is to stay committed to the process and make consistent efforts to improve your creditworthiness.

In conclusion, the duration of credit repair depends on several factors, including the severity of your credit issues, the number of negative items on your report, and your commitment to the process. While there are no guaranteed shortcuts, taking proactive steps to address inaccuracies, pay down debt, and establish positive credit history can help you see results faster. Remember that patience is essential, and with time and effort, you can achieve a healthier credit score and better financial stability.

So, if you’re wondering how long it takes to repair your credit, the answer is that it varies. But with determination and the right strategies, you can pave the way to a brighter financial future.