Credit Repair After Identity Theft: How to Reclaim Your Financial Freedom

Identity theft is a serious and increasingly common crime that can wreak havoc on your personal finances and credit. If you’ve fallen victim to identity theft, you’re not alone, and there are steps you can take to repair your credit and regain control of your financial future. In this comprehensive guide, we’ll explore the impact of identity theft on your credit and provide you with a step-by-step plan for credit repair after identity theft.

Understanding the Impact of Identity Theft on Your Credit

Before we dive into the credit repair process, let’s take a moment to understand how identity theft can affect your credit:

-

Unauthorized Accounts:

Identity thieves may open credit accounts in your name without your knowledge or consent. These accounts can accumulate debt that affects your credit score.

-

Missed Payments:

If the identity thief uses your credit accounts and fails to make payments, it can result in late payments on your credit report, negatively impacting your credit score.

-

Collection Accounts:

Unpaid debts may be sent to collections, appearing as collection accounts on your credit report, further damaging your credit.

-

Credit Inquiries:

Identity theft can lead to unauthorized credit inquiries, which can lower your credit score.

Step 1: Detect and Report Identity Theft

The first step in repairing your credit after identity theft is detecting and reporting the theft:

-

Review Your Credit Reports:

Obtain copies of your credit reports from all three major credit bureaus—Equifax, Experian, and TransUnion. Look for any unfamiliar accounts or suspicious activity.

-

Report the Theft:

Contact the Federal Trade Commission (FTC) at IdentityTheft.gov to report the identity theft. This will initiate the recovery process and provide you with valuable resources.

-

Contact Credit Bureaus:

Notify the credit bureaus about the identity theft. They can place a fraud alert on your credit reports to prevent further unauthorized activity.

-

File a Police Report:

In some cases, you may need to file a police report to document the identity theft. This report can be essential when disputing fraudulent accounts.

Step 2: Dispute Fraudulent Accounts and Information

Once you’ve reported the identity theft, it’s time to dispute the fraudulent accounts and information on your credit reports:

-

Gather Evidence:

Collect any documentation related to the identity theft, such as copies of the police report, correspondence with creditors, or any other relevant information.

-

Write a Dispute Letter:

Compose a formal dispute letter to the credit bureaus, explaining the fraudulent accounts and providing supporting evidence. Be clear and concise in your communication.

-

Dispute with Creditors:

Contact the creditors associated with the fraudulent accounts and inform them of the identity theft. Request that they close the accounts and remove them from your credit report.

-

Monitor Progress:

Stay vigilant and monitor your credit reports for updates. The credit bureaus are required to investigate your disputes and make corrections within 30 days.

Step 3: Restore Your Credit

With the fraudulent accounts addressed, it’s time to focus on restoring your credit:

-

Establish Positive Credit:

Consider opening a secured credit card or becoming an authorized user on a trusted friend or family member’s account. Positive credit history can offset the negative impact of identity theft.

-

Pay Bills on Time:

Consistently make on-time payments for all your credit accounts and bills. Payment history is a significant factor in your credit score.

-

Reduce Debt:

Work on paying down any existing debt. Lowering your credit utilization ratio (credit card balances compared to credit limits) can positively impact your credit score.

-

Be Cautious:

Protect your personal information rigorously. Monitor your financial accounts and be cautious about sharing sensitive information online.

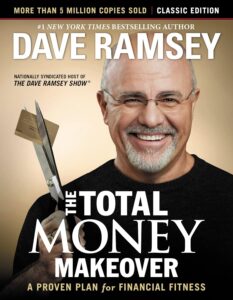

Learn Budgeting and Personal Finance While Playing this Fun Game!

Step 4: Continuously Monitor Your Credit

Identity theft can have lasting effects, so it’s crucial to remain vigilant:

-

Use Credit Monitoring Services:

Consider using credit monitoring services that provide regular updates on your credit score and report changes.

-

Check for Errors:

Continuously review your credit reports for errors or inaccuracies. If any issues arise, dispute them promptly.

-

Renew Fraud Alerts:

Renew the fraud alert on your credit reports every 90 days to maintain added security.

Step 5: Seek Legal or Professional Help

In some cases, repairing your credit after identity theft may require legal or professional assistance:

-

Consult an Attorney:

If the identity theft has resulted in substantial financial losses or complicated legal issues, consult with an attorney who specializes in identity theft cases.

-

Credit Repair Services:

Consider enlisting the help of reputable credit repair services experienced in dealing with identity theft-related credit issues.

Conclusion

Identity theft is a distressing experience, but it’s possible to repair your credit and regain control of your financial life. By following the steps outlined in this guide, you can minimize the long-term impact of identity theft on your credit and work towards rebuilding your financial security.

Remember that credit repair after identity theft is a process that requires patience and persistence. Stay committed to improving your credit, and with time, you can achieve a healthier credit score and greater financial peace of mind.

In the face of adversity, your journey to credit repair can ultimately lead to a brighter financial future. So, take the first step today and start your path to financial recovery after identity theft.

“This post may contain affiliate links. If you use these links to buy something we may earn a commission but you may gain some knowledge.”