How to Make Your House an Asset

“This post may contain affiliate links. If you use these links to buy something we may earn a commission but you may gain some knowledge.”

If you are reading this, it may already be too late for you in your current situation. This article is more about creating a plan for a future purchase of a home, but you still have a few options if you are trying to figure out how to make your house an asset.

Why Your House Is Not an Asset

My guess is that most of you have been told, your house is an asset, your whole life. Sadly, for 99% of you, you have been lied to. In most cases, when you go to sell your house, you are going to lose money, it’s just simple math.

There are definitely a few situations where you can make some money on appreciation alone, but it doesn’t happen very often. If you are able to buy a home in a bottom market and sell it at the right time, you may be able to sell it for more than everything you have in it.

When I say everything, let’s break down exactly what that means. Most people don’t consider the numbers we are going to look at in this article when they figure how much money they “made” on the sale of their home.

Let’s look at the biggest hidden number that nobody thinks about, interest on a mortgage. The average person lives in their home for 13 years. The average home cost in the US is $226,800. If you were to put down 20% on the purchase of the home, your mortgage would be$181,440. On top of that, you are going to have finance charges and closing costs, usually around 1.5%, so let’s say $2,721.6.

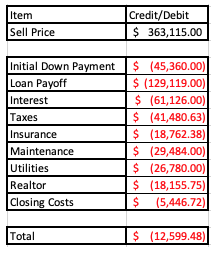

If you have a mortgage of $181,440 and we will give an interest rate of 3.25% on a 30-year mortgage, you will build approximately $52,321 in equity without any appreciation The average annual appreciation rate in the US is 3-5%. Let’s split the middle of the two and say you can sell the house for $363,115 in 13 years. You say to yourself, this isn’t too bad, but let’s factor in the rest of the numbers.

One of your largest expense is going to be interest paid over the 13-year period. The interest on your $181,440 over this time period will be $61,126. After interest there are a number of expenses that are going to dig into your profit over time.

Let’s start with everybody’s favorite, taxes. The average property tax on a home in the US is 1.1%. This gives us a total tax cost of $41,480.63 on the home price used above with appreciation figured in.

Next, we will look at insurance, the average annual insurance cost on a home in the US is $1443.26. This will give us a total cost of $18,762.38 over the 13 years. This number will vary greatly depending on the state you are in, but it gives us a good baseline to work with in this example.

We can’t forget about those maintenance costs that seem to add up at the end of the year. Changing out air filters in your HVAC, replacing the water heater when it goes out, fixing your fence after a tree limb falls on it. These are just the simple joys of home ownership.

On average, Americans spend 1-4% of the value of their home on maintenance every year. Let’s say the home you bought above is an extremely low maintenance home and we will use 1% in our example. This means that over the 13 years you own the home, you will spend approximately $29,484 on maintenance.

The next thing we will look at is utilities. The average American family spends $2,060 per year on utilities. This includes water, heating/cooling, Trash/Recycling, Phone, Internet and Cable. Over a span of 13 years that adds up to $26,780.

Of course, when you go to sell the house, you have to pay your realtor fees and closing costs. If you are able to sell the house for $363,115 and you get a realtor to list it for 5% and your closing costs are 1.5%, your bill at closing will be $23,602.47.

There are many other expenses we could consider, such as parking cost, home improvements, insurance claims and as many of you home owners know, the list goes on. Lets take a look at these numbers together and see how good of an investment your house is.

When you go to sell the house in this example, you may walk away from table with a $210,000 check, provided you’re not using it for the down payment on another house, but as you can see from the numbers above, you have actually lost money and held up 45,000 for 13 years with no return.

How to Make Your House an Asset

As we have shown above, the chances of you actually making money on the sale of your personal residence is not great. If you take the necessary steps, this does not have to be the case. There are several options available to you to change this, but they are not for everybody.

Rent Out Your Extra Room

If you have an extra room in your house/apartment that you’re not using, turn it into some extra cash. If you have an apartment in your basement or above your garage, rent it out to someone and bring in some extra cash.

By renting out your extra room you can bring in some extra cash and use it to put towards your mortgage and maintenance on the house. This of course comes with the reality of a stranger living in your house or on your property which would made most people uneasy.

Live in Your Flip

If you don’t mind living in a construction site, you can always live in a house while you remodel it. Almost every house I lived in growing up, this was the case. It drove my mother nuts, she hated everything about it.

The other downside to this is, you can’t live there very long. You are always moving. If you live in the house too long you start to get into those expenses that dig into your profit so hopefully you either have a strong back or a lot of friends to help you move.

I knew several people that did this in their younger years and did quite well, but as soon as they got married, their spouses put an end to it very quickly. If this is the route to go, make sure if you decide to settle down that your spouse is on board.

VRBO (Vacation Rental By Owner)

If you are the type that travels a lot, rent out your place while you’re not using it. There are several people that take advantage of this new business model and help cover their monthly costs. Make sure that if you live in an HOA that your HOA allows this.

If you travel for work or vacation a lot, why not make a little money on the side. This of course requires strangers living in your house and looking through all of your things, so this may not be for you.

Rent Out Space to a Business

This would obviously depend on where you live and the ordinances your community has in place but if you can make it happen, why not.

This doesn’t even have to run out of your house. If you live in an area with a big enough lot you could build a metal building on your property and rent it out to several types of business that don’t even need to be there, they just need a place to store stuff.

Live in a Duplex

You don’t always have to live in a single-family home. Buy a multi-family dwelling and rent out the other units. This also works for apartment buildings, quadraplexes an anything you could imagine. Buy a commercial building with an apartment upstairs and rent out the bottom to a retailer.

The idea here is to be creative and build assets before you start buying liabilities, which is what your personal residence will most likely be. Just remember that it doesn’t have to be permanent. Live here for a while, build equity, and do it again or buy a house with the equity you have built in this property.

Summary

As we have discussed in the article, it is very difficult to walk away with a profit from selling your personal residence. I’m not saying that you shouldn’t buy a house because we all have to live somewhere and just look at the money you do keep vs spending it on rent that you will never get back.

These are obviously not all of the examples of ways you could make an extra income from your personal residence but the idea is to get your creative mind working so that you can find opportunities in front of you when they appear and stop thinking like the mob.

If you want to make a real profit from you house, you have to start thinking in ways that the masses don’t. You may think it’s strange, whatever you decide to do, but if you do, you are probably on the right track.